For the last 15 years, I’ve lived and breathed software development, IT consulting, and fintech. During this time, I’ve seen many ‘next big things’ come and go. But when I first encountered blockchain, I realized this wasn’t just another tech trend. It was a fundamental shift in how we record the very history of our economy.

Think about it: the way we do accounting hasn’t fundamentally changed in 700 years. We are still relying on the Double Entry system – debits and credits – pioneered in the 14th century. But today, our world is too fast for 700-year-old tools. We need a system where trust is built into the code itself.

What Exactly is the ‘Block’ and the ‘Chain’?

When I explain blockchain to my colleagues, I tell them to forget the crypto hype for a second and look at the architecture. It’s actually quite simple when you break it down:

- The Block: Imagine this as a digital page in a ledger. It contains a list of transactions – who sent what to whom.

- The Chain: Each ‘page’ or block is linked to the previous one using a unique digital fingerprint called a ‘hash.’

- Immutability: This is the magic part. Because each block contains the fingerprint of the previous one, if you try to change a single digit in an old transaction, the fingerprint changes, the link breaks, and the entire network knows something is wrong. You cannot delete. You cannot edit. You can only add.

The ‘Goa Trip’ Problem: Why We Need a Shared Ledger

In my career, I’ve seen businesses lose millions – not to fraud, but to simple reconciliation errors. Traditionally, every company keeps its own books. Company A has its ledger, Company B has its ledger, and the bank has a third. At the end of the month, everyone spends days trying to make sure the numbers match.

I like to use a simple analogy: Imagine you and four friends are planning a trip to Goa or Jaipur. If each of you writes down expenses in your own private notebook, you’ll inevitably argue later. “I paid 2,000 for the hotel!” “No, I remember it was 1,500.“

However, if you all use one shared Google Sheet that everyone can see but no one can secretly edit, the ‘truth’ is established instantly. That is exactly what blockchain does for global finance. It provides one ‘Single Source of Truth.’

Moving from Double-Entry to Triple-Entry Accounting

This is where it gets exciting for finance professionals. We are moving toward Triple-Entry Accounting.

- Entry 1: The Seller’s record.

- Entry 2: The Buyer’s record.

- Entry 3: The transaction itself, recorded on a public or permissioned ledger that both parties (and auditors) can see in real-time.

This eliminates the need for expensive third-party intermediaries. In trade finance, for example, we often use ‘Letters of Credit’ to establish trust between a buyer in India and a seller in the US. This process is slow and full of fees. With blockchain, the ‘Trust’ is provided by the network, not a middleman.

How the Network Agrees: Consensus and Smart Contracts

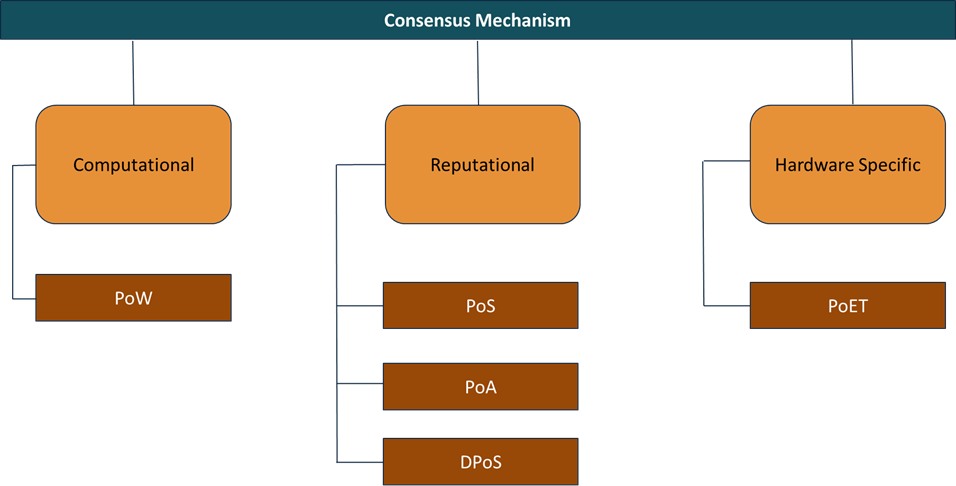

You might wonder, “If there is no central boss, who decides which transaction is valid?” This is handled by Consensus Mechanisms.

- Computational

- Proof of Work (PoW): The classic method where computers solve complex puzzles to validate data (used by Bitcoin).

- Reputational

- Proof of Stake (PoS): This is an alternative to PoW. It allows validators to create blocks based on the number of coins they have and are willing to ‘stake’ as collaterals.

- Proof of Authority (PoA): A more modern, energy-efficient version used by businesses. Here, only trusted entities like a group of banks or a government body have the authority to validate the ledger.

- Delegated Proof of Stake (DPoS): Here, stakeholders elect delegate validators to maintain the blockchain.

- Hardware Specific

- Proof of Elapsed Time (PoET): This works by assigning each node a random wait time, allowing them to rest before ‘waking up’ to process a new block.

Smart Contracts

These are self-executing pieces of code. I often describe them as “If/Then” statements for money. If the ship reaches the port in Mumbai, then the payment is automatically released to the supplier. No paperwork, no delays.

They:

- Self-execute programmes

- Automate accounting logic

- Trigger recording of financial events

- Act as accounting processes in code

Public vs. Private: Which one for Business?

In my work with startups and financial institutions, I’ve found that “one size does not fit all.”

- Public Blockchains: Like Ethereum, where anyone can join. Great for transparency but often lacks the privacy businesses need.

- Permissioned (Private) Blockchains: This is what most of my corporate clients use. It gives you the security and speed of blockchain but ensures that only authorized participants can see sensitive financial data.

| Property | Public Blockchain Network | Private Blockchain Network |

|---|---|---|

| Authority | Decentralized | Partially Decentralized |

| Access | Anyone | Single Organization |

| Transaction Speed | Slow | Fast |

| Consensus | Permissionless | Permissioned |

| Transaction Cost | High | Low |

| Data Handling | R/W for anyone | R/W for single organization |

| Immutability | Full | Partial |

| Efficiency | Low | High |

Bridging the Gap in Your Career

The transition to digital assets and blockchain-based ledgers is happening right now. Central banks around the world are already experimenting with Digital Currencies (CBDCs). If you are in accounting or finance, the ‘old way’ of doing things is quickly becoming a liability.

To stay relevant, you need to understand how technology and finance intersect. This is exactly what we focus on in the Online BBA (Honors) in Financial Technology and other specialized finance programs at MAHE. These courses are designed to take these complex concepts and turn them into practical skills you can use to lead the digital transformation in your own organization.

The ledger of the future is being written today – make sure you know how to read it.

Prepare for your next career milestone with us