Listen to this blog

Finance is a topic that has piqued the curiosity of everyone, whether a businessperson or a college student. An MBA in finance degree program is widely regarded as the most desirable and well-known course. It opens up a world of possibilities in business, banking, investing, stock markets, and insurance, among others.

A career in finance offers diverse opportunities, high earning potential, and job stability. It involves managing money, making strategic decisions, and analyzing market trends. Choosing finance provides a path to challenging roles in investment banking, wealth management, or corporate finance. It’s ideal for individuals with strong analytical skills, a passion for business, and a desire for continuous growth in a dynamic industry.

MBA in finance is now a widely recognized and favored professional path for individuals worldwide. An MBA in finance teaches and enhances leadership skills, analytical, rational reasoning, and other skills. It gives learners hands-on exposure that builds a solid career basis, and it assists them in gaining a comprehensive understanding of the financial industry.

Also read: How to build a career in finance after a BBA degree

What is an MBA in finance?

An MBA in Finance is a Master of Business Administration degree with a specialization in finance. It is a postgraduate program that focuses on providing students with a comprehensive understanding of financial management, investment analysis, risk assessment, and corporate finance. The curriculum typically covers topics such as financial accounting, financial modeling, portfolio management, mergers and acquisitions, derivatives, and international finance. An MBA in Finance equips graduates with the knowledge and skills necessary to pursue various high-level roles in the finance industry and corporate sectors.

Finance encompasses funds, capital, money, and the management of all of its components. All of these, and much more. Therefore, while addressing the question ‘why MBA in finance,’ it’s always best to start with the basics.

Overview of MBA in finance degree

| Aspect | Description |

| Degree Level | Master of Business Administration (MBA) |

| Duration | Typically 2 years (Full-time) |

| Fee Range | INR 5 lakhs to 30 lakhs (varies based on the institute) |

| Skills Gained | Financial Analysis and Decision-making, , Risk Management and Derivatives, Corporate Finance and Valuation, Strategic Financial Planning, and more. |

| Top Jobs | Investment Banker, Portfolio Manager, Risk Manager, Corporate Treasurer, Financial Analyst, and more |

| Top Hiring Companies | Goldman Sachs, J.P. Morgan Chase, Infosys, TCS, Wipro, HDFC, ICICI, L&T, and more |

| Salary Range | INR 8 lakhs to 30+ lakhs per annum (varies with experience) |

Check out: Why choose an MBA in Finance

Who should do an MBA in finance?

An MBA in Finance is an excellent choice for individuals who have a strong interest in the finance industry and aspire to pursue leadership roles in finance-related fields. One must be able to work with numbers and balance sheets and have a passion for financial analysis and crisis management.

To get admission into an MBA program a minimum of 50% in their graduation degree and a good score in entrance exams like the CAT, MAT, or GMAT are required. Job experience in the management and business fields is a plus. The eligibility criteria vary from university to university.

Also read: How to choose between Finance and HR specializations

MBA in Finance: Syllabus and subjects

An MBA finance is divided into four semesters with different subjects that equip learners with all the aspects of finance. Let us have a closer look at the syllabus of online MBA in finance course offered by Manipal University Jaipur (MUJ)

First semester

- Management Process and Organizational Behavior

- Business Communication

- Statistics for Management

- Financial and Management Accounting

- Managerial Economics

- Human Resource Management

Second semester

- Production and Operations Management

- Financial Management

- Marketing Management

- Management Information System

- Operations Research

- Project Management

Third semester

- Research Methodology

- Legal Aspects of Business

- Security Analysis and Portfolio Management

- Mergers and Acquisitions

- Taxation Management

- Internal Audit and Control

Fourth semester

- Strategic Management and Business Policy

- International Business Management

- Business Leadership

- International Financial Management

- Treasury Management

- Merchant Banking and Financial Services

- Insurance and Risk Management

Also read: Important concepts to learn in an MBA in finance course

MBA in Finance: Topics for case studies

The ability to develop a suitable research subject is a vital responsibility. You may choose the case study depending on your area of interest from all MBA finance subjects. Here are a few ideas you can work upon:

Investment Portfolio Management: Design and manage a virtual investment portfolio. Monitor and track the performance of various investments, make strategic asset allocation decisions, and evaluate the overall portfolio’s risk and return.

Financial Technology (FinTech) : Explore the impact of emerging financial technologies on traditional financial services. Develop a FinTech innovation project that addresses a specific financial industry challenge.

Merger and Acquisition (M&A): Conduct a case study on a recent M&A deal. Analyze the financial implications, synergy potential, and post-merger performance of the companies involved.

Risk Management in a Financial Institution: Assess the risk management practices of a bank or financial institution. Develop risk mitigation strategies and suggest improvements to enhance the institution’s risk management framework.

Financial Analysis of a Company: Choose a publicly traded company and perform an in-depth financial analysis, including analyzing its financial statements, profitability, liquidity, and solvency ratios. Present a comprehensive report with recommendations for financial improvements.

Working Capital Optimization for a Business: Analyze the working capital management of a company. Identify inefficiencies and propose strategies to optimize its working capital, thereby improving liquidity and profitability.

Valuation of a Startup or Small Business: Value a startup or a small business using various valuation methods like Discounted Cash Flow (DCF), Comparable Company Analysis (CCA), and Transaction Multiples. Provide insights on the potential for investment or acquisition.

Sustainable Finance and Socially Responsible Investing (SRI): Investigate the integration of environmental, social, and governance (ESG) factors in investment decision-making. Analyze the performance of SRI portfolios compared to conventional portfolios.

Check out: Interesting topics for MBA case studies

Is an MBA in finance worth it?

An MBA in finance is a challenging degree that you should consider pursuing. The following factors make an MBA a suitable choice.

- Finance is crucial

Finance is among the most vital sectors in any country. As a result, by pursuing an MBA in finance, you will be a part of an industry that affects all enterprises, sectors, and nations. You will always be protected, and your career and business will always be safe.

- Technologically oriented

Many careers are becoming obsolete because of technological advancements, but this will not be the case for the finance sector. This sector has embraced technology and is using it to propel growth. As a result, because your MBA in finance degree teaches you how to use technology, you will also participate in the digital revolution.

- Industry selection

Finance plays a role in almost every aspect of life. There is no way to start a business without finance, and it is essential even for governments to function. As a result, with an MBA in finance, you can choose to work for any organization or industry. You can land your ideal job, earn a lot, and have a rewarding career.

- Demanding profession

The financial industry includes some of the most demanding jobs. These positions need you to keep up with current corporate sector events and be highly knowledgeable. The financial markets’ instability adds to the burden. The rewards, though, are worth it if you can handle the strain and perform effectively. If you work in finance, you will never have a monotonous workday.

- High salaries

Finance is all about money; therefore, it’s only logical that the pay in this sector is competitive. Finance professionals who excel at their jobs earn a lot of profit, as this sector entails a significant amount of risk.

Check out: High-paying finance jobs in India

Future scope of MBA in finance

In a nation with one of the major global financial markets and an economy that produces many multinational corporations, an MBA in finance has great potential. This degree will open up many employment options for you, most of which will pay substantially, like:

- Financial Analyst

- Portfolio Manager

- Financial Advisor

- Treasury Manager

- Investment Banker

- Risk Manager

- Hedge Fund Manager

Check out: An easy guide on how to become a financial analyst

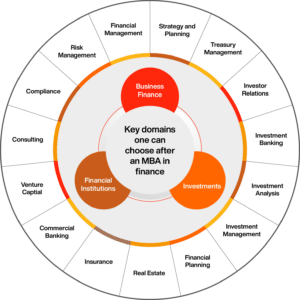

Industries you can work after an MBA in Finance

Students considering finance career path have various job opportunities to consider. Because of the vastness of this domain, you can choose to work in a variety of fields with different career options after MBA, including:

- Insurance companies

- Commercial and investment banks

- Credit unions and private banks

- Corporate management

- International financial management

- Investment services

- Financial planning services

There is always a necessity for an MBA in finance, making this program highly adaptable and in demand. In terms of how financial statements are to be handled, corporate sectors demand financial help. Only financial managers can deal with how the finances should be controlled and managed in a way that does not jeopardize the company’s reputation or credibility in the market. As a result, an MBA in finance will become in-demand in the future.

Check out: A guide on how to get a job in the finance sector

Get an online MBA in finance through Online Manipal

Become a future-ready finance professional by enrolling in an online MBA degree offered by Manipal University Jaipur. Learners who pursue an MBA in finance will be prepared with all the in-demand financial skills and knowledge, ensuring they are on the right track.

The online MBA program can help you advance your career as a finance manager, finance auditor, public accountant, portfolio manager, risk manager, and more. MBA finance curriculum delves deeply into all facets of finance and economic management, ensuring that you succeed in your career.

Expert faculty, career-oriented webinars, meticulously crafted curriculum, 24/7 student support, and placement assistance are some of the salient features of online programs offered on Online Manipal.

Also read: Things you need to know about online MBA in Finance

Conclusion

An MBA in finance will be an added advantage for those looking to progress in the finance sector. Besides, it also plays a significant part in molding the individual whose priorities lie in finance and who enjoys the realm of capital, currency, money, and assets.

A career in finance is all about income, status, and security. It’s a fantastic time to sign up for an MBA in finance if you want to build a successful career on these foundations. However, it is critical to recognize that employment in finance necessitates a superior cognitive process, perseverance, and hard effort.

Apply for an MBA in finance online course at Manipal University Jaipur, if you want to get the most out of your MBA in finance. You will not only be a part of a fantastic industry, but you will also have a prosperous and satisfying career with this qualification.

Prepare for your next career milestone with us