Listen to this blog

Finance is a dynamic and rewarding field that offers a wide range of career opportunities. Whether you’re interested in investment banking, financial analysis, or corporate finance, the finance sector provides abundant prospects for growth and success.

The financial industry is expanding at a breakneck pace, opening up a slew of new job prospects in the corporate world. A vocation in finance could be exciting and financially lucrative, and with so many details available, it’s tough to find helpful advice about getting started. It’s a well-known high-paying domain, with top executives earning six or seven figures in wages and incentives. Compared to other fields, even individuals on the bottom tier may start at a decent salary.

Finance is among the sectors that will always be prominent in various fields, such as business, commerce, retail, banking, etc. As a result, jobs in financial services will always be relevant and growing.

Check out: Best online degree courses in banking and finance

Scope and demand for a career in finance

The finance industry plays a crucial role in the global economy, and the demand for finance professionals continues to grow. According to recent statistics from the Bureau of Labor Statistics, jobs in business and finance occupations are projected to increase by 7 percent by 2031. This growth can be attributed to various factors, including the increasing complexity of financial markets, the need for financial planning and analysis, and the rising demand for financial services in emerging markets.

Additionally, advancements in technology have opened up new avenues in finance, such as fintech and digital banking, creating even more opportunities for professionals in the field. With the increasing focus on sustainable investing and environmental, social, and governance (ESG) considerations, finance professionals with expertise in sustainability and ethical investing are also in high demand.

There are many prospects for long-term advancement in a financial career path, regardless of the type of industry you join. Most jobs in the finance sector entail handling money, analyzing financial data, or executing similar activities. People in this area have a high probability of rapid career advancement because they can constantly transition to different roles based on their talents and interests. With so much room for improvement, this field will be valued and sought in the future.

Some of the top jobs you can explore in the finance sector

Entry-level jobs in finance

If you’re just starting your career in finance, there are several entry-level positions that can serve as a steppingstone to higher-level roles. These positions typically require a bachelor’s degree in finance, accounting, or a related field. Here are some entry-level jobs you can consider:

Financial Analyst: Assists in analyzing financial data, preparing reports, and providing recommendations to support decision-making.

Accountant: Handles financial transactions, maintains records, and prepares financial statements for organizations.

Credit Analyst: Evaluates creditworthiness of individuals or businesses and determines appropriate lending terms.

Investment Banking Analyst: Assists senior professionals in executing financial transactions, conducting market research, and creating financial models.

Financial Planner: Helps clients with personal financial planning, including budgeting, investments, and retirement planning.

Treasury Analyst: Supports cash management activities, analyzes cash flows, and assists in optimizing the organization’s liquidity position.

Risk Analyst: Identifies and assesses potential risks that may impact a company’s financial performance and develops risk mitigation strategies.

Trader: Executes trades on behalf of the firm or clients under the supervision of senior traders or portfolio managers.

High-paying jobs in finance

Once you gain experience and advance your skills in the finance industry, you can pursue high-paying positions that offer greater responsibilities and opportunities for growth. These roles often require a master’s degree in finance or a related field, such as an MCom or MBA in finance. Here are some high-paying jobs you can aspire to:

Chief Financial Officer (CFO): The top financial executive responsible for overseeing financial operations and strategies within an organization.

Chief Investment Officer (CIO): In charge of managing investment portfolios and providing guidance on investment decisions.

Investment Banker: Leads major financial transactions, including mergers and acquisitions, IPOs, and other capital raising activities.

Hedge Fund Manager: Manages a hedge fund and makes investment decisions to achieve the fund’s objectives.

Private Equity Partner: A senior professional in a private equity firm who plays a key role in investment decisions and portfolio management.

Chief Risk Officer (CRO): Oversees the risk management function within an organization and ensures effective risk mitigation strategies are in place.

Finance Director: Leads the finance department and provides financial insights and advice to support the organization’s strategic objectives.

Portfolio Manager: Manages investment portfolios, making decisions to achieve optimal returns based on the fund’s objectives and risk tolerance.

Check out: Highest paying finance jobs in India

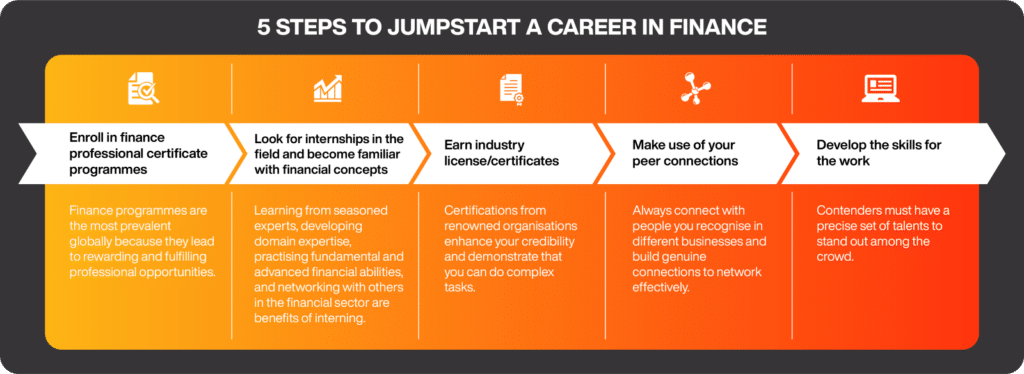

Step-by-Step guide to start a career in finance

Step 1: Obtain a relevant degree

To pursue a career in finance, it is essential to acquire a bachelor’s degree in finance, accounting, economics, or a related field like a BBA or BCom. This will provide you with a strong foundation in financial principles, accounting practices, and economic concepts. Earning an advanced degree like an MCom or MBA in finance can improve your chances further

Step 2: Gain practical experience

While studying, seek internships or part-time positions in finance-related roles to gain practical experience and apply your knowledge in real-world scenarios. This will help you develop essential skills, build your professional network, and make you more competitive in the job market.

Step 3: Develop specialized skills

To stand out in the finance industry, consider developing specialized skills that are in demand. This could include financial modeling, data analysis, programming languages like Python or R, or proficiency in financial software and tools. Continuous learning and staying updated with industry trends and regulations will also enhance your professional development.

Step 4: Earn professional certifications

Obtaining professional certifications in finance can demonstrate your expertise and commitment to the field. Consider pursuing certifications such as the Chartered Financial Analyst (CFA), Certified Financial Planner (CFP), or Certified Public Accountant (CPA), depending on your career goals and interests. These certifications can open doors to higher-level positions and potentially increase your earning potential.

Step 5: Build a professional network

Networking is crucial in the finance industry. Attend industry events, join professional organizations, and connect with finance professionals through platforms like LinkedIn. Building relationships with industry experts can provide valuable insights, mentorship opportunities, and potential job leads.

Step 6: Create a compelling resume

When applying for finance positions, tailor your resume and cover letter to highlight your relevant skills, experiences, and achievements. Emphasize your quantitative abilities, analytical thinking, and problem-solving skills. Use action verbs and quantify your accomplishments to demonstrate your impact in previous roles.

Step 7: Ace the interview

Prepare for finance job interviews by researching the company, practicing common interview questions, and showcasing your knowledge of financial concepts and industry trends. Be prepared to discuss your past experiences, your ability to work in a team, and your problem-solving skills. Demonstrate your passion for finance and your eagerness to contribute to the company’s success.

Step 8: Continue learning and growing

The finance industry is ever evolving, so it’s crucial to stay updated with industry developments and continue learning throughout your career. Pursue advanced degrees, attend professional development courses, and seek opportunities for professional growth. This will help you stay ahead of the curve and remain competitive in the finance industry.

Also read: How to start a successful career in finance after a BBA

Do I need a master’s degree for a job in the finance sector?

Master of Business Administration (MBA) in finance will improve your financial skills, business concepts, and understanding of the nation’s economy. It will allow you to lay the groundwork for understanding trading strategies, global and regional economics, mergers & acquisitions, insurance, and business risk, by providing practical and conceptual understanding.

You’ll also receive overall business knowledge, with the core of sessions about financial, investing, and banking themes. As a result, you will have a competitive advantage over your coworkers and peers in obtaining your chosen position in the sector.

Check out: How an MBA in finance helps advance your finance career

Kickstart your finance career with an online degree through Online Manipal

If you’re considering making a career in finance, you can do so by earning a bachelor’s degree like BBA or BCom in online mode from the NAAC A+ accredited Manipal University Jaipur. These online degrees are UGC-entitled and are treated equal to on-campus degrees and offer the flexibility to learn at one’s own pace from anywhere. Learners can attend live classes & industry webinars, access recorded classes & e-learning materials, and apply for scholarships. Learners looking to advance their career in the finance industry can enroll for an online MCom or MBA in Finance. All these programs have industry-relevant curriculum, expert mentorship, and placement assistance.

Also read: Why choose an MBA in finance

Conclusion

A career in finance can offer a fulfilling and rewarding professional journey. By following the step-by-step guide outlined in this article, you can pave the way for a successful career in finance, whether you’re starting at an entry-level position or aiming for high-level roles. Stay motivated, continue learning, and seize opportunities to grow and excel in the dynamic world of finance.

Become future-ready with our online MBA program