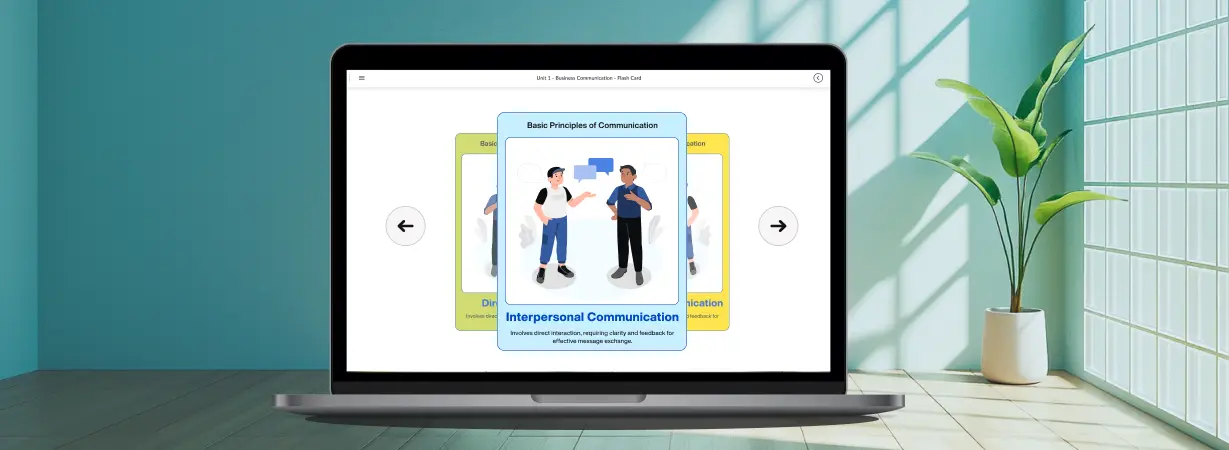

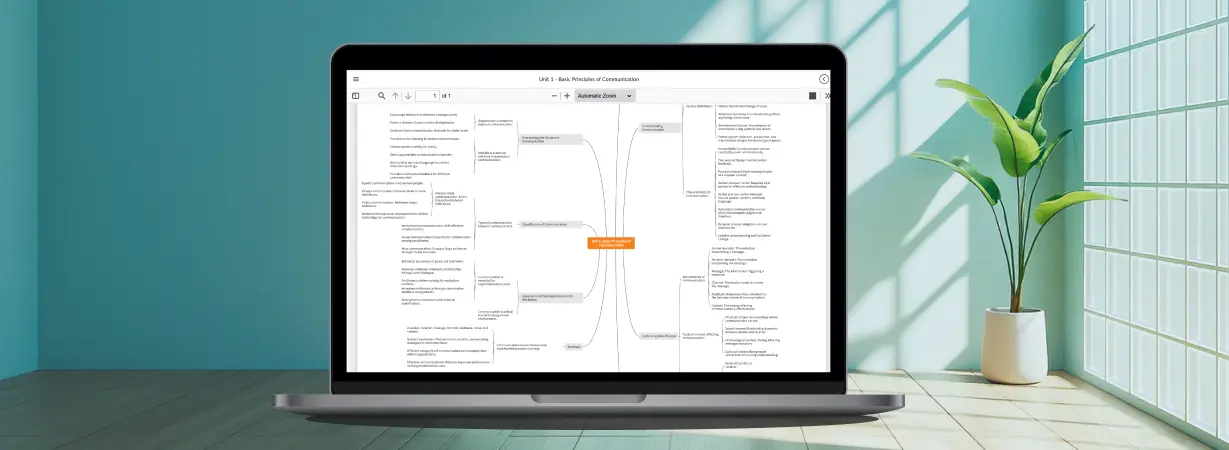

I have learned key financial skills through this MBA, which has helped my current career. As this is a management degree, in addition to finance, I have learned how to be a good manager. We were provided with study materials, attended live lectures, completed assignments, and took online exams that gave me an on-campus feeling. The online exams were conducted with flexibility for working professionals.

I have learned key financial skills through this MBA, which has helped my current career. As this is a management degree, in addition to finance, I have learned how to be a good manager. We were provided with study materials, attended live lectures, completed assignments, and took online exams that gave me an on-campus' ...