Listen to this blog

Choosing the right degree option, right after completion of their 12th can be a challenging task for students. One should make an informed decision by weighing in many factors as it is a crucial decision that defines your career trajectory. BCom and BBA are the two most common choices that students are usually presented with after their 12th.

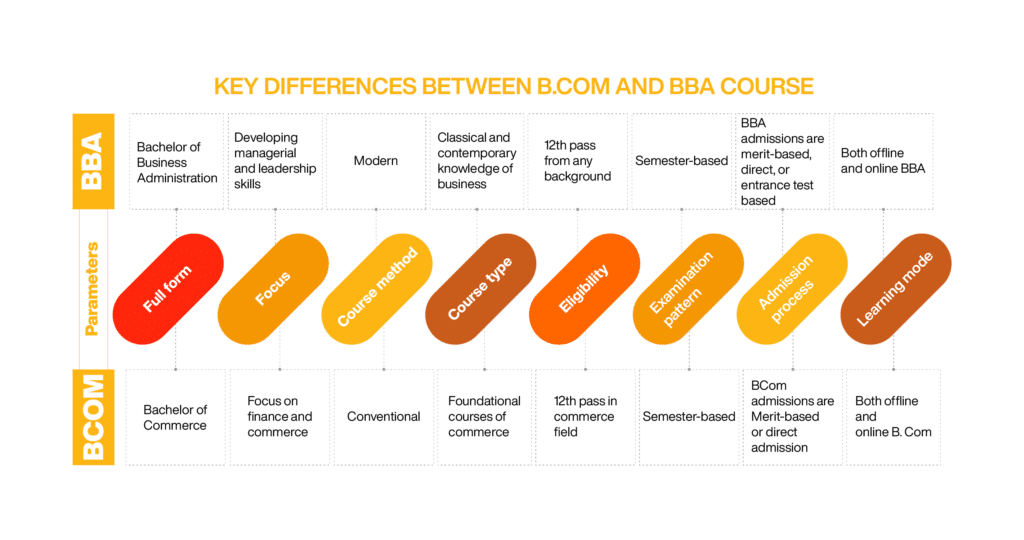

BCom offers a comprehensive understanding of commerce, economics, and finance while online BBA program focuses on business management and administration. The career prospects vary too. BCom graduates often find themselves in roles like accountancy, banking, or finance, while BBA graduates lean towards managerial positions. This article delves into each degree, its scope, career prospects, and higher education possibilities.

What is BBA?

Bachelor of Business Administration (BBA) is an undergraduate program that focuses on business management and administration. It provides students with a comprehensive understanding of various facets of the business world, including marketing, finance, human resources, and entrepreneurship. The BBA course duration is typically 3 years and is divided into 6 semesters.

Check out our Online BBA program and give your career a boost.

What is BCom?

Bachelor of Commerce (BCom) is an undergraduate program that offers a broad foundation in commerce-related subjects, including accounting, finance, economics, and business management. It typically spans three years which is divided into 6 semesters.

Know more about B.Com course details.

BBA Vs BCom Scope

BBA

BBA offers a wide range of opportunities and a strong foundation in business-related disciplines.

- Diverse career options: BBA graduates are well-equipped to pursue careers in various industries such as finance, marketing, human resources, and operations.

- Entrepreneurship: BBA programs often include coursework in entrepreneurship, making it an ideal choice for aspiring entrepreneurs.

- Managerial skills: The curriculum emphasizes developing leadership and managerial skills, which are valuable in any organization.

- Global perspective: BBA programs often incorporate international business concepts, preparing graduates for global careers.

BCom

Graduates with a BCom can pursue careers in various sectors, including accounting, finance, banking, marketing, and business management. They are equipped with skills in financial analysis, accounting principles, and business operations, making them valuable assets in both private and public organizations. BCom graduates can also choose to further their education through postgraduate programs like Master of Commerce (MCom) or Master of Business Administration (MBA) to specialize further and enhance their career prospects.

Career Options After BBA and BCom

Both BBA and BCom graduates are eligible to get jobs in finance, marketing, management, and public service fields, which are of various sectors. Here we are exploring BBA vs BCom job opportunities.

Top Jobs After BBA

Sales & marketing manager

They are responsible for leading a team of professionals who are involved in the sales and marketing activities of an organization. They must track market developments, develop marketing opportunities, create strategies, set up sales plans and ensure they’re implemented. They must possess in-depth knowledge and understanding of sales and marketing and have effective communication and leadership skills.

Management consultant

Management consultants help an organization solve issues, maximize the growth of a company and improve business performance. They perform quantitative and qualitative analysis to drive proposed solutions to various issues within the company. They can work in various sectors like banking, healthcare and engineering.

Business development manager

They are responsible for contacting potential clients and developing a strategy focused on financial gain. They identify new markets and satisfy customer needs. They keep a record of sales, revenue, invoices etc. They set goals for the development team and ensure the business is growing.

Operations manager

An operation manager is a key part of the management team. They oversee the operational activities of an organization such as recruitment, training, and other day-to-day operations. They also oversee financial planning, management, budgets, product delivery and strategy.

Product manager

Product managers are go-to people for a product. They identify customer needs and the larger business objectives that need to be fulfilled and build a strategy. They are heavily involved in a wide range of responsibilities like planning, delivery, and marketing throughout the product life cycle. They prioritize customer needs, work with sales and marketing teams and define the product vision. Find out more about the skills required for a career in product management.

Top Jobs After BCom

Accountant

An accountant is required in every organization, irrespective of which sector you choose. An accountant is responsible for making critical financial decisions for the company by collecting, tracking, and correcting the company’s finances. They are also responsible for financial audits, and ensuring that the organization’s financial records are accurate.

Financial analyst

The job of a financial analyst involves analyzing financial data, analyzing past results, identifying trends, and making recommendations for improvement. They are also responsible for evaluating the financial performance of the company and maintaining a strong financial analysis foundation creating forecasts and models.

Business manager

A business manager must oversee the activities and performances of other workers, hire and train new employees, and ensure that each department in the company is contributing to financial goals. They also ensure whether there are enough resources for workers and prepare reports for the management.

Investment banker

An investment banker is responsible for raising capital for businesses and individuals by issuing debt and selling equity. They develop various financial models to value debt and equity, mergers, acquisitions and capital-raising transactions. They also develop relationships with new clients to expand business.

Financial risk manager

A financial risk manager is responsible for identifying threats to assets of the company, analyzing business risks and offering a solution. They must possess knowledge in managing financial risks and work with banks, insurance companies and accounting firms. They work in various fields from financial services to marketing.

Skills Developed After BBA and Bcom

The following are some of the primary skills that students usually learned when they did their BBA and BCom courses, which are beneficial for them to flourish in different professions.

BBA

Analytical skills

As part of your education, a BBA degree requires you to complete a lot of analysis. You will also master sophisticated analytical software, which is now a necessity for most management roles.

Presentation skills

Making presentations is an essential aspect of BBA degree programs and all related jobs. Presentations are a common and efficient form of visual communication in business.

Accounting skills

As part of the BBA program, you will learn about all company operations, including accounting. To succeed, you must be naturally gifted with numbers.

Management: BBA graduates learn fundamental principles of management, including organizational behavior, resource allocation, and project supervision.

Financial acumen: BBA students gain a strong foundation in finance, accounting, and economics, enabling them to understand financial statements, perform financial analysis, and manage budgets effectively.

Marketing skills: Understanding consumer behavior, market research, and marketing strategies is essential in various business roles. BBA programs often include coursework in marketing.

Entrepreneurial mindset: Many BBA programs foster an entrepreneurial mindset, encouraging graduates to think creatively, take calculated risks, and explore opportunities for innovation and entrepreneurship.

BCom

Computer skills

All professional learning, including BCom, is now computer-based. You must be adept in the use of computers and other software programs that will benefit you in your studies.

Accounting skills

Accounting is a vital component of BCom. There are several jobs in accounting to explore after a BCom degree, so it is important to acquire accounting skills. To thrive in your job, you must be strong with numbers.

Taxation skills

Another vital element in BCom is taxation. You must have a strong knowledge of the country’s tax system, including laws and regulations and their applications. Tax knowledge will offer you a variety of professional opportunities.

Analytical skills

Analyzing figures, laws, and regulations, as well as utilizing analytical software, are significant parts of the course and professions, therefore you must be able to do analyses.

Research skills

BCom is a theoretical subject that necessitates extensive investigation. To perform well in the course, you must have solid research skills.

You may be interested to know about the skills required for a BCom fresher.

Higher Studies After BBA and BCom

Upon finishing one’s BBA or BCom, students have the option of taking a number of postgraduate courses which will help them to learn more and greatly improve their career path in the future.

After BBA

BBA graduates who wish to further their education and expand their career prospects can consider various postgraduate options. Here are some common paths they can pursue:

- Master of Business Administration (MBA): Pursuing an Online MBA is a popular choice, as it provides advanced business knowledge and can lead to higher-level management positions.

- Master of Science in Management (MSM): This program focuses on advanced management concepts and is suitable for those seeking specialized knowledge.

- Master of Human Resource Management (MHRM): Ideal for those interested in specializing in human resources.

- Master of International Business (MIB): Suitable for those who want to focus on global business and international markets.

- Master of Finance (MFin): For individuals interested in finance and investment management.

- Master of Marketing (MM): Designed for those aiming to specialize in marketing and branding.

After BCom

BCom graduates seeking to enhance their qualifications and career prospects can consider pursuing higher studies. Here are some common postgraduate options:

- Master of Commerce (MCom): Provides in-depth knowledge in commerce-related subjects and is an ideal choice for those looking to specialize further.

- Master of Business Administration (MBA): An MBA can open doors to leadership roles and offers a broader understanding of business management.

- Chartered Accountancy (CA): Ideal for those interested in pursuing a career as a chartered accountant.

- Certified Management Accountant (CMA): Focuses on management accounting and financial management.

- Company Secretary (CS): For those interested in legal and corporate governance aspects of businesses.

- Master of Finance (MFin): Suitable for individuals looking to specialize in finance and investment.

Eligibility for BBA and BCom

- 10+2 from a recognized National or State board institution

- 10+3 diploma from a recognized national or state institute

- At least 45% marks in aggregate in 10+2 / Diploma (40% for reserved categories)

(The above information is based on eligibility criteria for online BBA and BCom programs at Manipal University Jaipur)

Read more about Common Universities Entrance Test (CUET) examination details.

Course Curriculum: BCom Vs BBA

| Course curriculum | BCom | BBA |

|---|---|---|

| Semester 1 | General English Economic theory Fundamentals of accounting I Business organization Principles of business management | Communication skills & personality development Organizational Behavior Business environment Marketing management Computer fundamentals |

| Semester 2 | Computer awareness & internet Marketing management Fundamentals of accounting II Business law Fundamentals of entrepreneurship & innovation Economic environment in India | Business communication Financial accounting Human resource management Quality management Retail management |

| Semester 3 | Business communication Financial management Cost accounting Business statistics Financial statement interpretation | Legal & regulatory framework Quantitative techniques for management Research methodology Financial management Advertising & sales |

| Semester 4 | Indirect taxes Corporate finance Corporate accounting Environmental science Human resource management | Business strategy Management information systems Management accounting Environmental science International marketing Rural marketing |

| Semester 5 | Management accounting Investment options and mutual funds Money & banking eCommerce International trade & finance | Consumer behavior Business analytics Elective- General management Elective- Retail management |

| Semester 6 | Entrepreneurship development Principles & practice of auditing Business environment Direct taxes Dissertation | Customer relationship management Digital marketing Elective- General management Elective- Retail management |

BBA vs BCom: Top Specializations Offered

| BBA Specializations | BCom Specializations |

|---|---|

| Finance Marketing HR International Business Banking & Insurance Digital Marketing Entrepreneurship and Family Business Logistics & Supply-Chain Hospitality Sports Management Data Analytics Retail and E-commerce | Accounting & Finance Economics Investment Management Banking & Insurance Financial Markets Computer Applications E-Commerce Business Analytics |

BBA vs BCom Salary

BBA Salary Prospects

| Job Profile | Average Salary (INR) |

|---|---|

| Marketing Executive | ₹1.4 Lakh – ₹6.5 Lakhs per year |

| Financial Analyst | ₹2.2 Lakhs – ₹13.3 Lakhs per year |

| Executive Assistant | ₹1.8 Lakh – ₹12 Lakhs per year |

| HR Generalist | ₹2.2 Lakhs – ₹6.5 Lakhs per year |

| Business Development Executive | ₹3L – ₹6L/yr |

| Senior Business Analyst | ₹9L – ₹17.0L/yr |

BCom Salary Prospects

| Job Profile | Average Salary (INR) |

|---|---|

| Personal Financial Consultant | ₹1.2 Lakh – ₹8.5 Lakhs per year |

| Banking and Finance Officer | ₹15K – ₹25K/month |

| Investment Analyst | ₹3 Lakhs – ₹33 Lakhs per year |

| Accountant | ₹15K – ₹30K/month |

| Tax Consultant | ₹5L – ₹7L/yr |

| Financial Controller | ₹7.8 Lakhs – ₹57.2 Lakhs per year |

BBA vs BCom: Which is Better?

The best solution for you depends solely on your goals — there’s no single best choice for everyone.

| If You Value… | Better Pick | Why |

|---|---|---|

| Managerial & leadership exposure from day one | BBA | Skill-packed curriculum, live projects |

| Depth in accounting & finance, CA/CFA aspirations | BCom | Strong theoretical base, exam exemptions |

| Creative marketing or startup ambitions | BBA | Covers branding, entrepreneurship |

| Public-sector & competitive exams (SSC, banking) | BCom | Commerce knowledge aligns with exam syllabi |

The Online Manipal advantage

Online degrees are definitely the way forward in today’s world. Be it flexibility, accessibility, or cost-effectiveness, there are several factors that have made online degrees more desirable. In that sense, pursuing a degree from top universities like Manipal University Jaipur (MUJ) and Manipal Academy of Higher Education (MAHE) through the Online Manipal platform can secure your future.

MUJ’s online BCom degree is designed to build competencies required in the field of commerce. On the other hand, the online BBA program is attuned to the latest pedagogy and prepares you for many contours your professional life might take. So, make the right decision for a bright future in these in-demand programs.

Both these online undergraduate programs come with a plethora of exceptional benefits. Students can apply for scholarships, avail easy financing options for fee payment, access live as well pre-recorded lectures, online learning materials, attend webinars from industry experts, and get placement support

Frequently Asked Questions on BCom vs BBA

1. Is it possible to pursue an MBA after BCom?

Absolutely! The majority of the top B-schools have a BCom degree as a requirement; if you have a solid quantitative base, there will be an advantage in the areas of finance and analytics (electives).

2. Is it necessary to have mathematics as a subject in BBA?

It is not necessary in all colleges, however, institutions may expect 10+2 student who major in maths or have statistics as one of the subjects for getting admission in their BBA programs.

3. Which degree is better for government jobs?

Both are accepted, but BCom aligns closely with SSC-CGL, banking exams and accounts officer roles.

4. Do BBA graduates earn more than BCom graduates?

Salary is based on employee’s job position, industry, and professional expertise. Both qualifications provide a high salary level and career growth

Prepare for your next career milestone with us