Listen to this blog

Over the past decade, data analytics has emerged as a major buzzword. The BFSI industry is experiencing a spike in data generation in today’s unpredictable business landscape. Thus, making it necessary for individuals in this sector to be adept at strong analytical skills. This sector has witnessed an upsurge in the adoption of analytics, which can be attributed to assisting businesses in deriving insightful conclusions from enormous quantities of data.

Professionals can analyze client behavior patterns, evaluate risks, spot market trends, and optimize corporate processes thanks to analytics. Personnel in the BFSI sector who hold expertise in analytics can efficiently evaluate large data sets, implement data-driven initiatives, improve consumer experiences, mitigate risks, and grab novel opportunities.

Read more: Decoding the impact of big data analytics in the banking sector

Advantages of possessing analytics skills for BFSI professionals

Professionals in the BFSI sector can benefit from having analytics skills in several ways. A few of the advantages of possessing analytics skills for BFSI professionals are explained below.

- Analyzing large volumes of data:

BFSI personnel with analytics skills can quickly analyze and decipher massive amounts of data. Professionals can learn significant details regarding risk profiles, market dynamics, and client behavior by skillfully analyzing this data. This analysis aids in pinpointing trends, patterns, and oddities that can impact business strategy and decision-making.

- Data-driven decisions:

Professionals in the BFSI sector can leverage data analytics tools to guide their decision-making processes. Experts can identify potential threats, streamline operational processes, and create effective strategies by using statistical frameworks, predictive analysis, and machine learning techniques. This data-driven methodology improves decision accuracy and lowers the probability of making expensive mistakes.

- Product development:

Professionals can pinpoint unmet needs, preferred options, and new business prospects by analyzing consumer data and industry trends. They can then employ these insights to generate fresh offerings that are tailored to specific customer categories. Additionally, analytics aids in the optimization of product attributes, pricing, and distribution plans based on data-driven conclusions. It can lead to improved client satisfaction and business expansion.

- Staying competitive in the industry:

Organizations in the BFSI sector that successfully apply analytics to derive valuable insights from data acquire a competitive advantage. Professionals are better able to provide personalized services, improve client experiences, and proactively handle risks if they have a better understanding of customer behavior, market conditions, and risk profiles than their opponents. This exalts the organization to the forefront of its domain and enhances its potential to adapt to shifting market dynamics.

Read more: Thriving in the BFSI Industry: Essential skills for today’s professionals

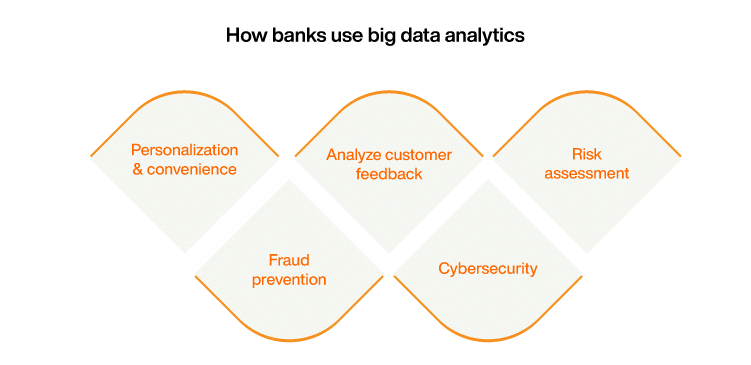

Application of analytics in banking and finance

The use of analytics in banking and finance has risen. From detecting fraudulent activities, risk management, business optimization to credit risk analysis, analytics is used in the BFSI industry for multiple reasons.

- Fraud detection and risk management:

Analytics assists financial institutions in spotting and intervening in fraudulent actions by analyzing massive volumes of data and identifying trends or discrepancies. Machine learning algorithms can continuously monitor transactions, detect suspect patterns, and generate alerts for further inquiry. Analytics can help banks proactively manage risks, safeguard client funds, and uphold the reliability of financial systems.

- Credit risk analysis:

Analytics assist banks and lenders in managing credit risk by evaluating creditworthiness. Banks can assess the risk of default and establish reasonable loan limits by examining historical data, financial documents, credit scores, along with other pertinent indicators. Advanced analytics models can additionally incorporate other data sources, like macroeconomic indicators or market trends, to raise the precision of credit risk assessments. This allows banks to manage an intact loan portfolio while making wise lending choices.

- Customer insights and personalized services:

Banks can uncover valuable insights about the behavior, preferences, and demands of their customers thanks to analytics. Banks can segment their clientele to develop individualized services by analyzing transaction data, demographic data, and client interactions. Cross-selling opportunities, custom product or service recommendations, and personalized marketing campaigns can all be accomplished with analytics.

- AI-powered virtual assistants:

AI and analytics collaborate to facilitate the development of chatbots or virtual assistants that can assist consumers with their banking inquiries and activities. These AI-powered advisors leverage ML algorithms and NLP (Natural language processing) to comprehend consumer requests, respond precisely, and carry out tasks. Virtual assistants can keep learning from client conversations, increase their accuracy, and offer more tailored and effective services via analytics.

- Business performance optimization:

Banks can pinpoint inefficient regions, restructure procedures, and cut expenses by analyzing internal data, market dynamics, and industry standards. The efficacy of risk management, channel success, product profitability, and client acquisition and retention can all be gleaned from analytics. Banks can improve resource allocation, increase operational effectiveness, and provide better financial results by using this data-driven decision-making strategy.

Read more: How will digital transformation reshape the future of banking in India?

Top analytics job roles in banking and finance

Discussed below are some of the top analytics job roles available in banking and finance, along with their highest estimated salaries::

Credit risk analyst

The assessment and management of credit risks related to lending and investing activities are under the purview of a credit risk analyst. They examine financial information, assess creditworthiness, and offer suggestions to lessen prospective losses. They also create risk models and keep track of portfolio performance. The highest estimated salary of a credit risk analyst is ₹ 20.0 Lakhs.

Compliance manager

A compliance manager makes certain that a financial institution abides by all applicable laws, rules, and internal procedures. They create compliance programs, carry out audits, and offer direction on compliance-related issues. They also keep a gaze on modifications to regulatory standards while making the necessary adjustments. The highest estimated salary of a compliance manager is ₹ 25.0 Lakhs.

Big data analyst

Big data analysts leverage data analytics approaches to extract information from huge databases. They gather, filter, and analyze financial data to uncover patterns, indications, and correlations. Additionally, they create predictive analytics models, design data models, and offer data-driven suggestions to enhance company decision-making. The highest estimated salary of a big data analyst is ₹ 17.0 Lakhs

.

Fraud prevention analyst

Fraud prevention analyst focuses on recognizing and terminating fraudulent activity within a financial organization. They perform an analysis of transactional data, seek out patterns and abnormalities, and put fraud control mechanisms in place. In addition, they investigate shady operations in conjunction with police enforcement. The highest estimated salary of a fraud prevention analyst is ₹ 8.0 Lakhs.

Pursue an online MBA in BKFS from TAPMI

Professionals have the opportunity to keep up with the rapidly evolving developments in the BFSI industry with the MBA in Banking and Financial Services (BKFS) program offered by T.A. Pai Management Institute through Online Manipal. Analytics for Banking and Finance is a noteworthy elective in this program that imparts participants with the expertise and skills needed to make data-driven conclusions. The most recent pedagogy used by TAPMI emphasizes combining theoretical understanding with real-world applications to create a well-rounded educational experience.

Read more: How analytics in banking and finance opens doors to lucrative job roles in banks

Professionals obtain an in-depth knowledge of analytics techniques and their relevance in the banking and finance business via immersive online sessions, case studies, and industry collaborations. This program ensures that learners become well-equipped to deal with the BFSI industry’s complexity while utilizing the latest analytical resources and techniques.

Become future-ready with our online MBA program