Listen to this blog

Big data analytics, a transformational force in the banking industry, is revolutionizing how financial institutions operate and reach strategic decisions. With the exponential development of data volumes and advancements in analytical tools, banks now have unparalleled access to huge quantities of organized and unorganized data. This amount of data gives an unprecedented chance for banks to gather useful insights, boost risk management, increase operational efficiency, and provide personalized customer experiences.

Role of big data analytics in the digital world

Big data analytics is transforming the way businesses operate in the digital era. Data analytics empowers financial organizations to extract valuable insights from enormous quantities of data in this ever-shifting setting. Banks and financial institutions can streamline their decision-making procedures, operational effectiveness, and customer satisfaction by leveraging complex algorithms along with machine learning techniques. Banks may implement analytics to analyze consumer behavior patterns, anticipate their preferences, and provide tailored financial solutions.

Furthermore, it aids in the discovery of fraudulent activity via recognizing anomalies and real-time monitoring, hence strengthening protection mechanisms. Also, data analytics aids in assessing and handling risks by offering precise models for credit rating, funding approvals, and strategies for investing. Overall, the incorporation of big data analytics in banking and finance has reshaped the sector by encouraging innovation, propelling growth, and facilitating a more secure and customized financial ecosystem.

Also read: Why BFSI professionals should stay abreast of trends in banking.

Impact of technology in today’s banking

Technology has boosted efficiency, accessibility, and security in the banking business, redefining how financial services are offered and consumed. It has resulted in the advent of the Internet and mobile banking, which allows clients to access their accounts, conduct transactions, and monitor their finances at any time and from anywhere.

Furthermore, advances in data analytics and AI have enabled banks to collect and analyze massive volumes of client data to provide tailored services, detect fraud, and make more intelligent business choices. Blockchain technology has increased transaction security and transparency, while fintech technologies such as mobile wallets and app-based payments have widened the array of digital payment choices available.

UPI (Unified Payments Interface), which began in India and is now gaining traction globally, is one notable example of technological impact in today’s banking system. UPI has created a paradigm change in the traditional financial landscape by harnessing the potential of smartphones and the Internet.

UPI has fostered cashless transactions and decreased dependency on physical currency. As a result, banks’ cash handling costs have dipped, financial transactions have become more transparent, and the likelihood of counterfeit currency has been reduced. The success and significance of UPI in India have attracted global attention, leading to its international expansion. The universal acceptance of UPI demonstrates its efficacy and ability to transform the global banking sector. Ultimately, technical advancements in the banking environment, epitomized by UPI, have ushered in a new era of ease, efficiency, and financial integration.

Also read: Top emerging technologies in financial services and how to upskill in them.

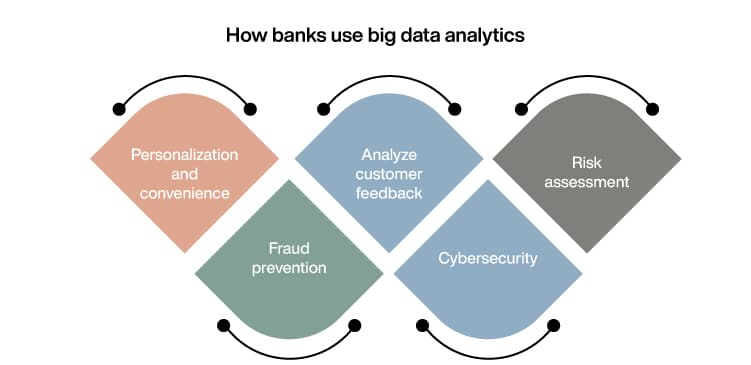

How banks are using big data analytics

Here are a few instances of big data analytics applied to the banking industry:

- Personalization and convenience:

Banks can customize their offerings and services to individual consumers by analyzing huge volumes of customer data, such as transaction history, spending trends, and demographic information. Big data analytics enables banks to optimize procedures and improve consumer convenience by providing personalized digital experiences like personalized financial dashboards, mobile banking applications, and chatbots that provide real-time support.

- Analyze customer feedback:

Banks can acquire significant insights from the feedback provided by consumers by using advanced analytical techniques, including sentiment analysis and natural language processing. They can uncover reiterating themes, sentiments, and client preferences to better their goods, services, and overall client experience. This study also assists banks in identifying developing trends and client pain spots, allowing them to address issues proactively and make educated business decisions.

- Risk assessment:

Banks can analyze and mitigate multiple risks more efficiently by evaluating enormous volumes of organized and unorganized data. They can detect probable fraud or money laundering by detecting trends and irregularities in financial transactions. This thorough examination increases the precision of risk models and lets banks make informed decisions while giving loans, offering credit cards, or delivering other financial services.

- Fraud prevention:

Banks can spot patterns and discrepancies that signal fraudulent activity in real-time by analyzing massive amounts of transactional data. Advanced machine learning algorithms can detect anomalous spending patterns, geographical inconsistencies, or questionable account behaviors and send notifications for further inquiry. Furthermore, banks can use network analysis tools to discover organized fraud schemes and identify linkages between fraudulent activity.

- Cybersecurity:

Banks can identify odd actions or possible security holes by analyzing vast amounts of data from numerous sources, such as network logs, user behavior, and threat intelligence feeds. Machine learning algorithms may recognize trends and clues to compromise, allowing institutions to respond to cyber attacks swiftly and efficiently. Big data analytics also aids institutions in legal investigations and the onset of proactive safety measures to reduce future dangers.

The future of big data analytics

The implications of big data analytics in banking hold remarkable opportunities for businesses attempting to capitalize on the wealth of data. Technological advances, such as the creation of IoT (Internet of Things) devices, sensor networks, and social media pathways, are likely to accelerate the proliferation of data sources. With the exponential rise of data volumes, more emphasis will be concentrated on formulating complex algorithms and ML models to extract crucial insights from enormous datasets.

Real-time data analytics will become increasingly popular, allowing organizations to harness the benefits of data-driven decision-making in banking. Furthermore, businesses get empowered to gain a deeper and more contextual understanding of data by blending Big Data analytics with cutting-edge technologies such as AI (Artificial Intelligence) and NLP (Natural Language Processing). Ultimately, Big Data analytics offers the power to transform businesses, elevate decision-making, and accelerate innovation in ways we have yet to fully comprehend.

Also read: How analytics in banking and finance opens doors to lucrative job roles in banks.

Pursue an MBA in BKFS from TAPMI

The online MBA in Banking and Financial Services (BKFS) course offered by T.A. Pai Management Institute (TAPMI) through Online Manipal is a premium course designed for working professionals. It provides a comprehensive curriculum and four industry-relevant elective baskets such as – Analytics for Banking & Finance, Banking, Capital Markets, and Advanced Corporate Finance. The course equips learners with the skills and knowledge needed to manage the ever-changing terrain of the financial industry with finesse and strategic acumen.

The Analytics for Banking & Finance elective offers an in-depth understanding of statistical modeling, data analysis, predictive analytics, and machine learning approaches specifically designed for the finance industry. The course will acquaint learners with powerful analytical tools to make data-driven choices, identify market patterns, efficiently manage risks, streamline operations, and design new strategies that fuel future growth and edge in the competitive financial services field.

Also read: Unlock opportunities in the BFSI sector with TAPMI’s online MBA-BKFS.

Conclusion

Big data analytics has substantial and far-reaching effects in the financial sector. As the banking sector integrates big data analytics, more advances in areas such as fraud detection, compliance monitoring, and predictive analytics are certain to happen, reinforcing the sector’s status as a game changer. Eventually, the role of data analytics in the banking industry holds utmost significance, and using big data analytics asserts to be crucial in shaping the prospects of banking, fostering innovation, and supporting long-term success.

Become future-ready with our online MBA program