Listen to this blog

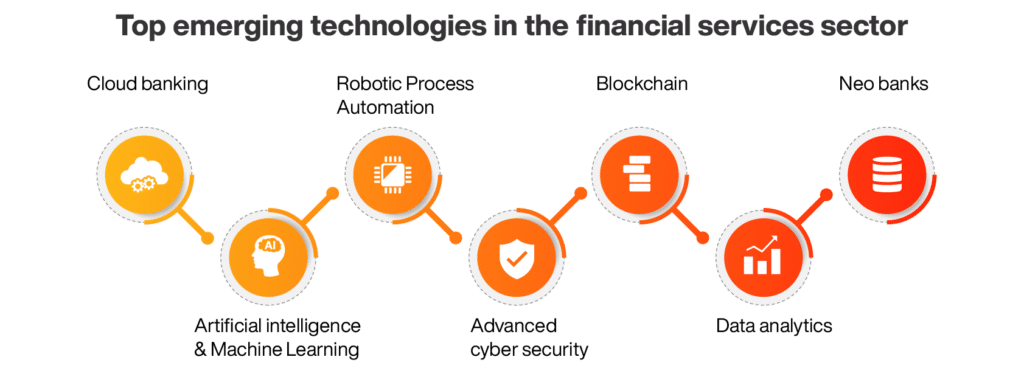

The future of the financial services industry is changing with digitization taking over the sector. The global financial services market is expected to grow at an 8.8% compound annual growth rate (CAGR) from $25848.74 billion in 2022 to $28115.02 billion in 2023. Thus, the need for new, innovative ways to save money, invest and borrow has never been greater. With this comes the need for new technology to support these needs. Here are some of the top technologies in banking and financial services that are completely transforming the sector:

- Cloud banking

Cloud banking is a new way of banking and is more convenient, secure, and efficient than traditional payment processing methods. Cloud banking enables you to access your account information from any device anytime via the internet or mobile device. You can also use this technology to make payments through an app on your phone or tablet without worrying about remembering passwords and PINs.

- Artificial intelligence & Machine Learning

Artificial intelligence (AI) and machine learning are the next big thing in financial services. AI can help banks with their day-to-day operations, including fraud detection and customer service. In addition to these benefits, AI technologies have the potential to transform how banks do business with their customers by automating processes that humans previously performed.

For example, if a customer sends an email requesting information about their account or making a payment request, AI could analyze this message automatically using natural language processing algorithms before sending it back to the client with relevant information attached. It would save time for both parties as well as reduce costs associated with manual workarounds like phone calls—all while enhancing user experience even further.

- Robotic Process Automation

Robotic process automation (RPA) uses software to automate business processes. It can include a variety of tasks, including data collection, scheduling, and reporting. RPA has been used in many industries over the past decade and has become increasingly popular as an alternative to human workers when it comes time to perform repetitive tasks that require little or no training.

Robotic process automation is often used in finance and insurance because these sectors have high volumes of repetitive tasks that humans cannot efficiently perform on their own (e.g., customer service). Robotic process automation makes sense because it enables businesses with constrained budgets or resources to access extra services without their staff investing extra time.

- Advanced cyber security

Cyber security is a major concern for financial services firms as cyber threats are a constant risk. Cyber attacks have become more common, but they’re also getting more sophisticated and difficult to combat. Cyber security challenges will only increase as new technologies like artificial intelligence become more widespread and widespread adoption of mobile technologies increases. As financial services firms continue to grapple with these issues, they need to be prepared for the future by investing in advanced cybersecurity measures before it’s too late.

- Blockchain

Blockchain is a distributed database that can be used to store and transfer data. It is decentralized, meaning it doesn’t require any central authority or middleman to validate transactions. Blockchain technology has been around since 2008 but has only recently become mainstream with the rise of cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

Blockchains are public ledgers where all users have access to read-only copies of the ledger. It makes them resistant to manipulation as there’s no central point of failure. Each node on a blockchain maintains its own copy of the information about past transactions in order for it to function properly so no hacker would have enough power over multiple nodes simultaneously.

- Data analytics

Data analytics is the process of using data to make sense of it and make predictions about future behavior. It can be used for many purposes, including improving business processes, customer satisfaction, and other aspects of your organization’s operations. Data analytics can be used to predict what customers will do or say in response to specific marketing campaigns or promotions. In some cases, this information can also be used as part of a decision-making process. Data analytics also allows companies to identify opportunities they might not have otherwise seen (e.g., understanding customer needs).

- Neo banks

Neo banks are a new type of bank that is being developed. They’re a mix of traditional banks and blockchain technology, with the goal of making fintech in banking and finance services more accessible to everyone around the world. Neo Banks have been around since 2017, but they’re still in their infancy phase. There aren’t many currently operational ones yet, but they’re expected to grow rapidly as more people become aware of them and want to use them for their own financial needs or business operations like loans and investments.

How to upskill yourself?

The TAPMI online MBA-BKFS program through Online Manipal is a fully accredited MBA program that offers working professionals in the BFSI sector the opportunity to gain a deep understanding of the role of the financial services industry in today’s world. The program is specially designed to cater to working professionals with 3 – 5 years of working experience in the BFSI sector and to prepare them for leadership roles in finance, banking, and other related fields.

The curriculum includes 4 industry-oriented electives – Analytics for banking and finance, Banking, Capital Markets, and Advanced Corporate Finance. Learners will also be introduced to the skills and knowledge necessary for advancing to managerial positions in the BFSI industry. Learners will gain command over significant areas, such as digital transformation in the banking sector, cryptocurrency and blockchain technology and other innovations in the banking sector.

Conclusion

In conclusion, emerging technologies are a great way to upskill in the financial sector. They’re fast-moving, constantly changing, and can help you keep up with your industry and stay ahead of competitors. And because these technologies are moving so quickly, it’s important to be ready for them when they come. By keeping up-to-date on the latest developments in your field and learning new skills through online courses or apprenticeships, you’ll be able to use these technologies in your work and be more successful than others who aren’t as well versed with them.

Become future-ready with our online MBA program