A comprehensive analysis of both direct and indirect taxes is going to be carried out over the period of the next six months, under the light of the Union Budget 2024-25. The Budget proposes a full explanation of the structure of the Goods and Services Tax (GST) tax, as well as a review of the structure of the Custom Duty rate structure, in order to boost domestic industry and bring the tax base up to date. The elementary goal of this writing is to conduct an in-depth analysis of the new tax regime, previous new tax regime and old tax regime pertaining to income tax compliance.

New tax regime

During the discussion on the budget, it is acknowledged that two thirds of the people who are taxed on income have made the transition to the new tax regime already. Only in the event that the evaded income is fifty lakh rupees or more, and only for a maximum term of five years from the end of the assessment year, will reassessment be allowed to be opened beyond three years from the end of the assessment year. The time limit for search cases will be lowered, going from ten years to six years before the year of search. This change will take effect sometime in the near future.

When compared to earnings made over a short period of time on specific financial assets, which will be subject to a tax rate of 20%, long-term gains on all financial and non-financial assets will be subject to a tax rate of 12.5%. For the goal of settling particular concerns concerning income tax that are now being appealed, the Vivad Se Vishwas Scheme, 2024 has been established.

Also read contribution to higher education in Union Budget 2025.

Tax deduction on salary

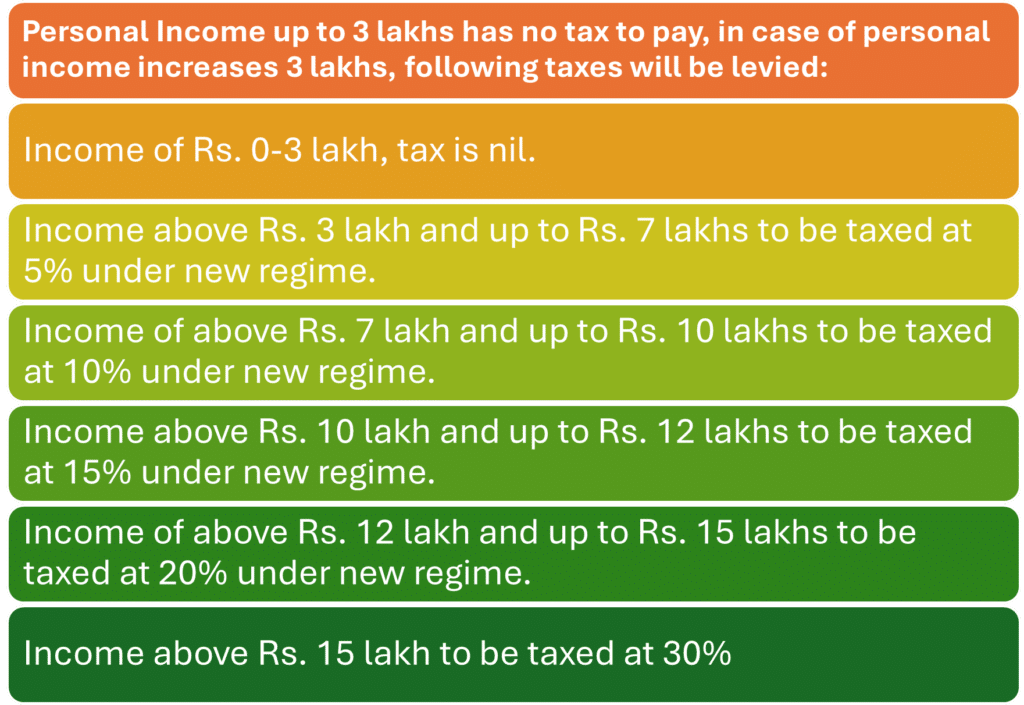

Beginning this year, the standard deduction for salaried workers who wish to take part in the new tax regime will be increased from Rs. 50,000 to Rs. 75,000. This increase will take effect from 2024-25. Furthermore, the amount of the income tax deduction that can be claimed for pensions has been raised from Rs. 15,000 to Rs. 25,000. Assessments can now be reopened for a period of five years, which is an increase from the previous three-year timeframe. As a consequence of the new tax policy, the tax rate has had to be adjusted. This is a list of the amended tax bands on income that are applicable under the new tax regime, which may be explored as below:

Comparing new and old tax regime

The income tax regime has undergone a very minor modification in compared to the regime that was in place the previous year. For the upcoming assessment year, taxpayers will have the choice to choose either the old regime or to opt for the new tax regime.

The absence of deductions, exemptions, and savings on investments is the primary distinction between the old system and the new regime. The new regime does not have any of these provisions. Let us now comprehend the distinction between the old regime and the new regime, as well as the distinction between the previous new regime (2021) and the latest new regime (2024).

You may also like- Union budget 2024: Key takeaways for higher education

The initial new tax regime had a tax slab that ranged from 2.5 lakhs to 3 lakhs, and the recent new regime has made a fifty thousand rupees increase while maintaining the same tax slab of 3 lakhs. In the most recent tax system, there is no tax bracket that is of 25%. A tax slab of 20% is followed by the tax slab of 30%. In contrast to the previous tax bracket, the new tax regime requires a payment of 20% for incomes ranging from 12 lakh to 15 lakh, whereas the prior tax bracket required a payment of 25%. Here is another important point to take in knowledge is that in latest new regime tax slab, are applicable for those with taxable income above 7 lakhs. Citizens whose annual income is less than seven lakhs are exempt from paying income tax. On income, more than 7 lakhs, the regime slabs will be applicable. This income free from tax was 5 lakhs in the pervious new regime.

Wrapping up

As we come to the end of this discussion, let us examine the differences between the latest (the most recent) and the previous tax regime to see the way they differ. The number of tax slabs has increased from four to six under the new tax framework, which has been expanded. Following the tax slab of 5% (2.5 to 5 lakh), the old tax regime is imposing a tax rate of 20% (5 to 10 lakh) on the taxpayer, a jump can be seen here from 5% to 20%. It is demonstrated in the situations that one pays a lower amount of tax under the new tax regime if we disregard the exemptions which are applicable to investments.

Deductions and exemptions are not available under the new tax system, which is another significant distinction between the two. As a result of the fact that the previous tax system was particularly accommodating to deductions and a wide variety of exemptions. HRA, LTA, education allowance, interest on loans, insurance, investments, and other types of deductions and exemptions from taxes are among the most common. It is possible to state clearly that the new tax regime is less complicated and more straightforward in contrast to the old tax framework. On the other hand, the previous tax regime is more convenient for individuals who wish to take advantage of tax benefits on deductions and investments.

HAPPY BUDGET AND HAPPY LEARNING!

Prepare for your next career milestone with us