Listen to this blog

Embedded finance is a relatively new concept that has emerged as a result of the increasing demand for more integrated and convenient financial services. In simple terms, it refers to the integration of financial services into non-financial products such as e-commerce platforms, social media platforms, and other digital services.

The development of APIs and other technologies has made it simpler for businesses to include financial services in their products, enabling them to provide clients with a more smooth and practical experience. The way we interact with financial services could change as a result of this trend, making them more approachable and user-friendly.

Yet, data security, privacy, and regulatory compliance are also significant issues that are brought up by embedded finance. It will be crucial to make sure that businesses are managing financial information safely and in accordance with applicable rules and regulations as they continue to investigate the potential of embedded finance.

Purpose of embedded finance

By incorporating financial services into non-financial products like e-commerce platforms, social media platforms, and other digital services, embedded finance aims to increase user accessibility and convenience for financial services while also generating new revenue streams for companies.

There are a number of reasons why companies can decide to incorporate financial services into their goods. By integrating financial services, businesses can eliminate the friction associated with traditional banking channels, making it easier and more efficient for clients to access financial services like payments, savings, and loans.

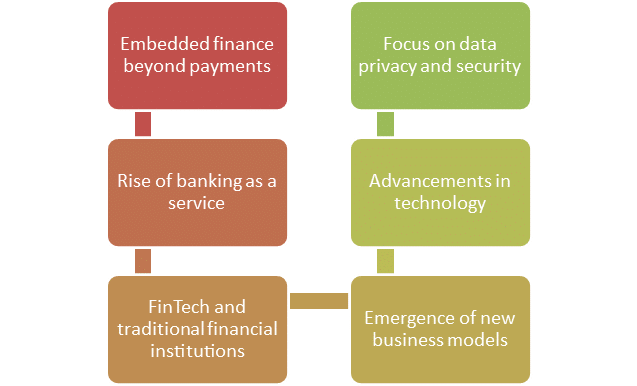

Key trends in embedded finance

There are several key trends in embedded finance that are shaping the future of the financial services industry. These include:

Mainly there are six key trends in embedded finance –

- Embedded finance beyond payments

- Rise of “banking as a service” (BaaS)

- FinTech and traditional financial institutions

- Emergence of new business models

- Advancements in technology

- Focus on data privacy and security

- Expansion of embedded finance beyond payments: Even though embedded finance places a lot of emphasis on payments, there is a growing trend towards integrating additional financial services with non-financial products. For instance, social media sites may offer investing possibilities, and e-commerce platforms may provide financing options to their users.

- Rise of “banking as a service”: The term “banking as a service” (Baa’ S) refers to the practice of financial institutions providing their services to outside businesses via APIs. As a result, these businesses can provide financial services to their clients without having to start from scratch with their own infrastructure.

- Increased collaboration between fin-tech’s and traditional financial institutions: Traditional financial institutions are increasingly partnering with fin-techs to leverage their technology and innovation in order to improve their products and services.

- Emergence of new business models: The integration of financial services into non-financial products is creating new business models, such as embedded insurance and embedded lending, which are disrupting traditional financial services.

- Advancements in technology: The development of new technologies, such as block-chain and artificial intelligence, is enabling new possibilities for embedded finance, such as creating more efficient and secure payment systems.

- Focus on data privacy and security: Because integrated finance now uses more personal data, there is a greater emphasis on data privacy and security. As a result, businesses are investing in cyber security tools and adhering to laws like the GDPR and CCPA.

You may like to know how to become a financial manager.

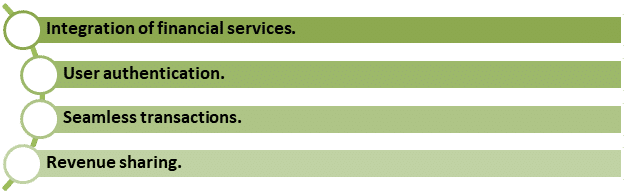

Working of embedded finance

The working of embedded finance involves the following steps:

- Integration of financial services

- User authentication

- Seamless transactions

- Revenue sharing

- Integration of financial services: Non-financial companies partner with financial institutions or fin-tech companies to integrate financial services into their platform. This can be done through APIs (Application Programming Interfaces) or SDKs (Software Development Kits) that allow seamless communication and exchange of data between the platform and financial service providers.

- User authentication: Users are required to authenticate their identity and link their bank accounts or credit/debit cards to the platform. This allows them to use financial services within the app, such as making payments, receiving loans, or managing their finances.

- Seamless transactions: Once authenticated, users can conduct financial transactions within the app, such as paying for products or services, transferring money, or investing in financial products. These transactions are processed in real-time, allowing for fast and convenient payment processing.

- Revenue sharing: Embedded finance platforms typically generate revenue through transaction fees, commissions, or revenue sharing agreements with financial service providers. This enables non-financial companies to generate additional revenue streams while providing a better user experience to their customers.

Examples of embedded finance

Listed a few examples of embedded finance –

- Embedded Payments: The integration of payment services into other platforms and apps is referred to as embedded payments. Users can, for instance, make payments directly from their mobile devices without using cash or credit cards thanks to digital wallets like Apple Pay and Google Pay. By integrating payments into other platforms and applications, users can conduct transactions without ever leaving the platform or application, streamlining and simplifying the payment process.

- Embedded Card Payments: Embedded card payments refer to the integration of card payments within other applications and platforms. Businesses can take card payments from their consumers by using card readers that certain firms, like Square and Stripe, provide for integration into their point of sale systems.

- Embedded Insurance: The integration of insurance services into other platforms and applications is referred to as embedded insurance. For instance, websites that help people rent or buy a home, like Zillow and Apartment List, also provide incorporated insurance services for their users, allowing them to buy insurance policies from the website. Similar to this, certain platforms for travel and transportation provide their clients with inbuilt insurance services that cover trip cancellations, aircraft delays, and mishaps.

Global impact of embedded finance

The global financial services sector could be significantly impacted by embedded finance. Financial services can be made more convenient and available to customers by being integrated into non-financial products. This can also open up new revenue opportunities for companies.

The potential for embedded finance to democratize access to financial services is one of the most important effects. Those who have historically been underserved by the financial sector may find it easier to access fundamental financial services like payments, savings, and loans by integrating financial services into everyday products. Those in developing nations who do not have access to conventional financial institutions may find this to be especially helpful.

Embedded finance can provide quicker, more effective, and more secure payment systems, lowering transaction costs and fraud, by utilizing new technologies like block chain and artificial intelligence.

While embedded finance has the potential to have a good effect on the financial services sector and the overall economy, it will also be vital to carefully assess the dangers and difficulties that could be involved with this development.

Know more about the career path of a financial advisor.

Next-generation embedded finance & revenue opportunities

Embedded finance is quickly changing, and the upcoming generation of embedded finance is being driven by a number of significant trends and developments. The growth of embedded finance into new sectors outside of e-commerce and social media platforms is a significant trend. Healthcare businesses, for instance, might incorporate payment and insurance services into their goods, whereas real estate firms might incorporate mortgage and loan services into their services. By utilizing their knowledge of financial services to deliver value-added services to new industries, financial institutions and third-party providers can take advantage of new income opportunities created by this growth.

Personalization is another emerging theme in embedded finance. Many businesses are leveraging data and analytics to give their clients tailored financial services. Another trend influencing the next generation of embedded finance is the rising usage of APIs. With APIs, businesses may quickly incorporate financial services into their goods and services, saving time and money on the development of their own financial infrastructure.

Financial institutions and third-party suppliers have excellent income prospects with the next generation of embedded finance. Companies can generate new revenue streams and better meet the changing demands of their clients by diversifying into new industries, personalizing financial services, utilizing APIs, and investigating cutting-edge technologies like De-Fi.

Conclusion

In conclusion, embedded finance is an exciting and rapidly growing field that has the potential to reshape the way we think about financial services. By integrating financial products and services directly into non-financial applications and processes, embedded finance is making it easier for businesses and individuals alike to access the financial services they need, when they need them. As the embedded finance ecosystem continues to evolve and mature, we can expect to see even more innovation and disruption in the financial services industry, driving greater efficiency, convenience, and inclusivity for all.

Enroll in a finance program to learn more about such newly emerging concepts like embedded finance. Online MBA in Finance from Manipal University Jaipur (MUJ) or Manipal Academy of Higher Education are the best programs to become future-ready professionals. The prestigious T.A. Pai Management Institute (TAPMI) also offers MBA-BKFS online, that covers several aspects of finance and banking in detail. To know more about these programs, visit Online Manipal.

Become future-ready with our online MBA program