Listen to this blog

Selling financial products calls for a solid grasp of both the products and the preferences of your potential customers. It entails establishing trust, proving knowledge, and articulating the intrinsic worth of your offerings effectively. In this guide, we will look at a variety of effective marketing tactics for financial product selling. You can upgrade your sales talents, foster strong client connections, and propel your success in the cutthroat financial sector by practicing these strategies.

What is a financial product selling?

Financial product selling is the process of promoting and disseminating multiple financial products and offerings for prospective clients. It encompasses providing a variety of investment, banking, and insurance, along with other financial services that meet the various needs and targets of individuals and corporations. Prospecting, needs evaluation, product presentation, negotiations, and accomplishing the sale are common actions and techniques for successful financial product selling.

Types of financial products in the market

The financial market offers a diverse selection of sophisticated goods designed to fulfill the needs of customers and investors. These goods fall into several categories, each providing a specific purpose. Investment products such as bonds, equities, and mutual funds enable individuals to get involved in capital markets and profit over time. There are also insurance products meant to reduce risks and give financial protection against unforeseeable disasters.

Additionally, credit and lending products, including mortgages and personal loans, make it easier for individuals and enterprises to obtain funds. Derivative products such as options and futures provide chances for price hedging and speculation. Specialized products, like ETFs (Exchange-traded funds) and REITs (Real estate investment trusts), are also available on the market, catering to certain investment preferences.

Who can benefit from financial product selling?

Financial product sales can benefit a variety of financial firms. Let’s look at the advantages each of them can gain by offering financial products:

- Commercial banks:

Selling financial goods enables commercial banks to strengthen customer connections, boost client retention, and raise their overall revenue. Banks can attract consumers and create revenue from interest, fees, and commissions by providing a variety of financial offerings, including loans, credit cards, mortgages, and savings accounts.

- Investment banks:

Investment banks are proficient in supporting corporations and governments in generating capital via operations such as IPO underwriting, bond issuance, and mergers and acquisitions. Investment banks can earn significant fees and commissions by providing such financial services and products.

- Insurance companies:

These firms provide a variety of insurance plans, including life insurance, health insurance, property insurance, and liability insurance. Insurance firms earn premiums from policyholders by offering these policies, which provides them with a steady source of finances. Insurance companies can mitigate risks for consumers and companies by selling financial products, which generates long-term profits and prospective investment returns.

- Financial planning firms:

Financial planning organizations evaluate clients’ financial objectives, risk tolerance, and situations to create tailored financial plans. Financial planning organizations can earn fees and commissions by providing a wide range of financial goods such as investment portfolios, retirement strategies, insurance policies, and estate planning services.

- Mutual funds institutions:

Mutual funds are investment vehicles that pool money from various individuals to invest in a diverse range of securities like stocks, bonds, and money market instruments. Offering mutual fund products enables these entities to gather AUM (assets under management) and levy management fees based on the AUM.

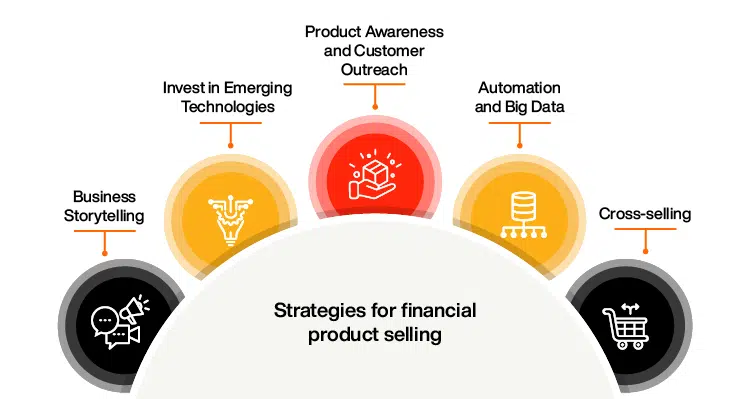

Effective strategies to sell financial products

Using efficient strategies can considerably increase the likelihood of success in selling financial products.

- Product Awareness and Customer Outreach:

Make certain that your target demographic is apprised of your financial goods. This involves carrying out market research to figure out potential clients and their requirements. Create tailored marketing efforts that emphasize your items’ unique characteristics and benefits. Leverage multiple methods to reach out to your customer base and raise brand awareness, including email marketing, social media, and content marketing.

- Invest in Emerging Technologies:

Maintain abreast with the most recent technology breakthroughs in the finance sector. Invest in products and platforms that will help you streamline your sales procedure and improve the customer experience. Explore the potential benefits of mobile applications, chatbots, and AI-powered assistants, for example, to communicate with clients in real-time and provide customized support.

- Automation and Big Data:

Make use of automation techniques and data analytics to expedite your sales processes and acquire useful insights. Automate monotonous processes like data entry and follow-ups, facilitating your sales force to zero in on building connections and closing contracts. Use big data analytics to uncover consumer patterns, preferences, and behavior, allowing you to modify your sales strategy accordingly.

- Business Storytelling:

Create captivating storylines that emotionally connect with your clientele. Use anecdotes to demonstrate how your financial solutions have improved the lives of current consumers. Underline real-life instances of success and testimonials that demonstrate the significance and reliability of your products. Effective narratives enable clients to comprehend the value of the goods you sell and foster trust.

- Cross-selling:

Use current customer relationships to sell additional financial goods. Examine your clients’ details and prior purchases to uncover cross-selling opportunities. You can increase client loyalty and income per customer by offering complimentary products or services.

Key skills for financial product selling

Here are some key talents for selling financial products:

- Negotiation Skills:

Strong negotiating abilities enable you to respond to concerns, conduct pricing conversations, and, eventually, close deals. Understanding your customer’s requirements and goals, developing win-win solutions, and striking mutually beneficial agreements are all part of this process.

- Sales Skills:

A good sales skill set allows you to create connections with consumers, overcome challenges, and drive them into making a purchase. Prospecting and lead generation, good interaction, attentive listening, and the ability to convey the worth and advantages of the product you’re selling are all part of the job.

- Customer Service Skills:

Providing outstanding customer service is critical for developing long-term partnerships and fostering client loyalty. It entails being responsive, empathic, and proactive in dealing with client needs and issues. You can ensure positive client service during the sales cycle and afterwards by exhibiting excellent customer service skills.

- Influencing Skills:

You can positively impact consumer decision-making and lead them to purchase your financial product by using compelling approaches and exhibiting competence. Understanding client motives, effectively delivering information, and adapting your approach to specific needs are all required for this talent.

Conclusion

Online MBA in BKFS (Banking and Financial Services) offered by TAPMI through Online Manipal has been precisely crafted to provide aspiring professionals with the skills and knowledge needed to flourish in the fast-paced financial sector. TAPMI ensures that students obtain a solid understanding of key financial principles and improve critical thinking skills by incorporating theoretical topics with real-world applications. Furthermore, the program provides specialized courses in areas like investment banking, risk management, and financial analytics, allowing students to develop highly sought-after specialized expertise in the financial sector. The TAPMI MBA BKFS program ensures that participants are prepared for employment in the financial sector through a combination of rigorous academia, industry relationships, and hands-on training, putting them on a path to lucrative and fulfilling careers.

Become future-ready with our online MBA program