Listen to this blog

This article will shed light on digitization in capital and securities market. How technological advancements are likely to open more avenues of revenues, drive up profitability along with highly efficient algorithms which will enable companies to analyze huge data at a much faster pace. The market regulator SEBI is taking steps to regularize and streamline the changes and protect the general traders and investors. Despite the risks involved, the Indian securities and capital market needs to adopt the technological changes and be in line with the global standards to attract new clients, capture new geographies and improve the quality of the industry and the market.

Introduction

The world is undergoing digitization at a rapid pace. The application of technology to create new software, business models, processes, and systems that result in increased efficiency, competitive dominance, more profitable revenues, high-performance IT systems, and highly efficient algorithms that allow for the exploration of large amounts of data is known as digital transformation. Data security issues are also particularly taken care of under data protection using more powerful sensors. Digitalization has manifested to be the global drift with an enormous sequel for economy, politics and society. As a result of digitalization, gainful employment and work-oriented society were the major concur for the transpose in the various other subareas.

Future capital markets will be technologically enabled. The technologies such as AI, Cloud Computing, Big Data Analysis, and Robotic Automation are considered major technological forces in the current times. Companies need to adapt to technology before being pushed aside by new aged technologically advanced competitors. Existing operating strategies and the continuous usage of obsolete technologies will not help organisations stay afloat in the long run.

Also read: Increase in demand for business education and non-tech jobs

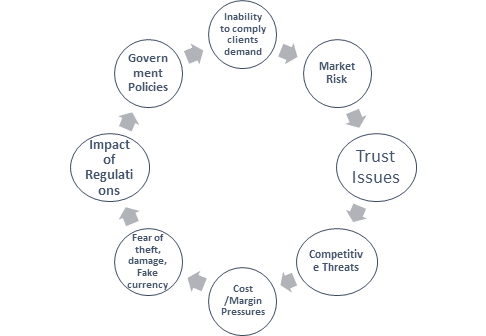

Major risks to be addressed by securities’ firms

Digitization – A game changer for Indian securities and capital market

The Indian capital market has come a long way from its inception in the nineteenth century, and today, it is considered to be in a good stage with a well-established framework. Financial products and services have become more available to a broader spectrum of customers thanks to the internet, which has also removed regional barriers. Previously, investors were completely influenced by their brokers, but today, they are actively involved in buying and sale of stocks over the internet. E-trading is saving time, energy, and money by allowing traders to access the market from anywhere at any time.

The E-payment system, which is driven by expectations, has hit a new high with benchmark performance. Many economic experiments have been conducted, ranging from e-wallets to insurance technology, e-funding to Agrotech, and blockchain to cryptocurrencies. These financial innovations stepped forth with a firm economic base, ensuring that digitization becomes an inseparable part of our economy.

Check out: How to make a career transition with online degree

Conclusion

Securities markets are going digital, and business processes are transforming. Accepting and adapting to the changes is the key. In this digital conversion, all securities markets’ members must partake their contribution. While clients require more online services, securities markets must contemplate the regulation strand of transformation, together with providing ways to use online services smoothly.

This swap is providing immense opportunities for developing a broad range of services. E-trading has saved a lot of time, money, and energy as one can ingress the market anytime from anywhere. The rural purchasers can also access data and services smoothly and effectively through digital commerce. Creation of robust and prudent infrastructure for carrying out this activity of users though mobile gateway or online mode is required.

An MBA in finance will help in acquainting yourself with extensive knowledge of securities and capital markets. The online MBA offered by the prestigious Manipal University Jaipur (MUJ) is at par with the on-campus MBA program and has a meticulously designed course curriculum. MUJ offers 13 popular and new-age electives to choose from. Candidates enrolled for online MBA from Manipal University Jaipur can benefit from the flexibility of the program schedule, exceptional teaching staff, course mentors, exhaustive-learning content, and placement training.

Become future-ready with our online MBA program